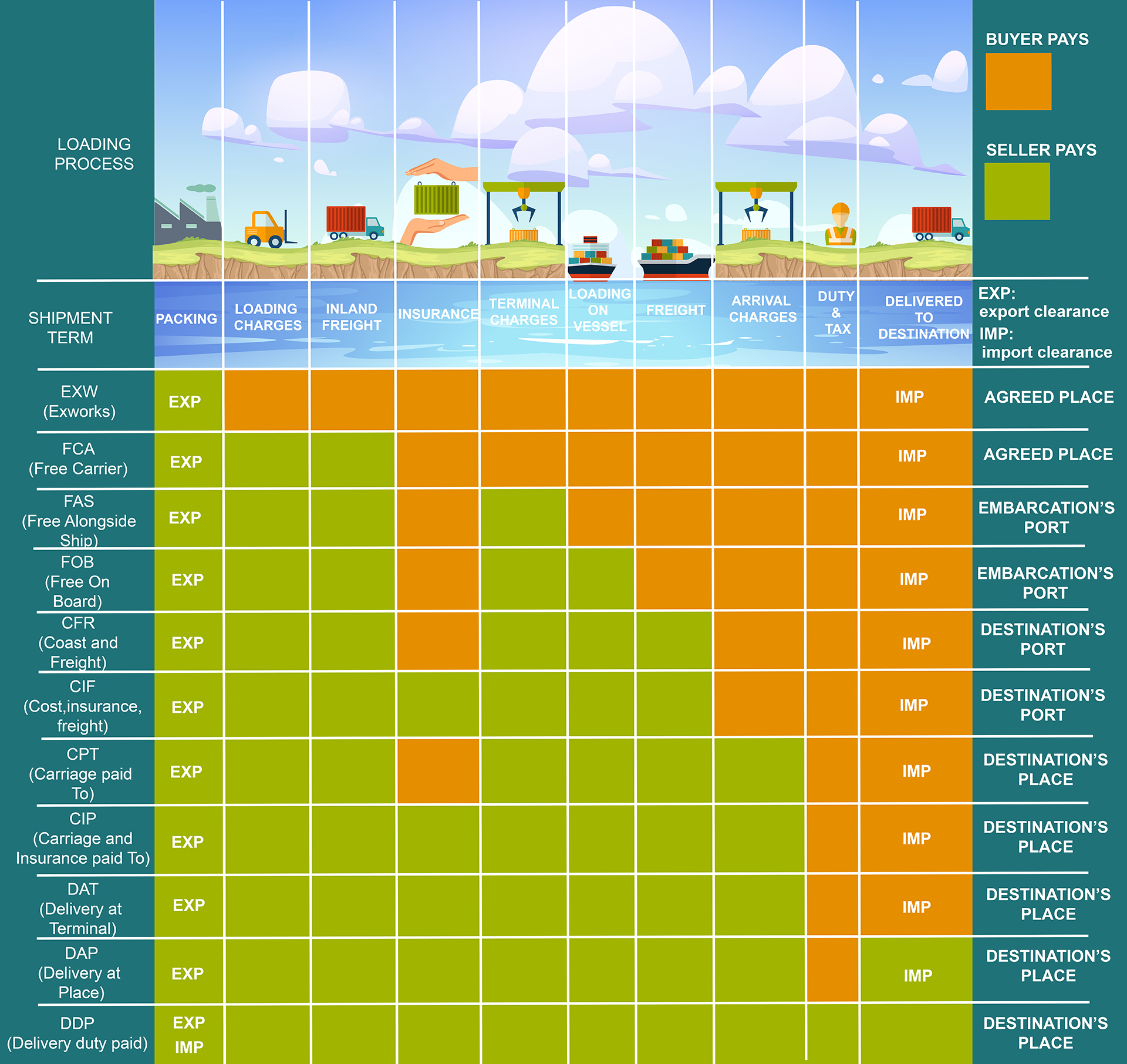

Incoterms

Exworks ( EXW)

Here, the seller has the least responsibility to the cargo, and agrees to deliver it to the seller’s premises. Once the goods are at the seller’s premises, the buyer is responsible for all risks and responsibilities.The buyer pays for the insurance, the export from the seller’s premises, and import to the destination. They also arrange all transport.This is often a term used when initially pricing up a delivery, but is less commonly used at the final pricing.

Free Carrier (FCA)

Unless otherwise agreed, the seller arranges and pays for fees up to the point of delivery. The delivery point can be the seller’s premises or elsewhere. In this case, the buyer pays for the export, the import, and arranges all transport.

Free Alongside Ship ( FAS)

The seller delivers the cargo to the buyer when the goods are alongside ship within reach of a ship’s lifting tackle. At this point, the risk passes to the buyer, who will arrange for the main carrier and pay for all insurance beyond this point.

Free On Board (FOB)

This incoterm is only used for sea transport. The seller delivers the shipment on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The risk passes from seller to buyer when the shipment is on board the vessel.

Cost and Freight (CFR)

The seller pays for and ensures freight delivery of the cargo, but the risk is with the buyer. Like an FOB delivery, the risk passes from seller to buyer when the shipment crosses the ship’s rail. As this incoterm demonstrates, the risk is not always with the party arranging the transport!

Cost, Insurance and Freight (CIF)

The main difference between CIF and CFR is that in CIF, the seller also pays for the insurance to cover the delivery of the goods up to the named port of destination. Due to the fact that the seller is covering the buyer’s risk during carriage, they will likely want to have the lowest-level insurance, meaning that the buyer may wish to take extra insurance out.

Carriage Paid To (CPT)

The seller contracts and pays for the shipment to be brought to the agreed place, but passes the risk to the buyer at this point. The buyer is also responsible for insurance from this point forwards, and the risk lands with the buyer when the seller arranges for the main carriage.

Carriage and Insurance Paid To (CIP)

This includes the responsibilities involved with CPT but, with CIP, the insurance is also paid by the seller up to the point of destination. The seller arranges insurance to cover the buyer’s risk, and pays for the main carrier to move the shipment to the destination point.

Delivered at Terminal (DAT)

The seller leaves the buyer responsible for the goods once they are unloaded at the agreed point of destination, meaning that the seller is responsible for their final unloading. The seller handles export fees, carriage, insurance, and destination port charges.

Delivered At Place ( DAP)

The seller has responsibility for the cargo until it arrives at its final destination, and the seller is responsible for all costs including export fees, carriage, insurance and port charges at destination.The buyer handles import fees and unloads.

Delivered Duty Paid ( DDP)

This is just about the opposite of EXW, as the seller has the most responsibility. They are responsible for delivering the goods to the buyer’s premises or any other place they agree to. The seller handles the cargo, pays for in export and import dues, arranges for transport, and pays for the insurance.